5-Year Forecast of the Chemical Distribution Market: Growth, Trends, and Key Drivers

The chemical distribution market, a crucial part of the global supply chain, is projected to grow significantly over the next five years. This market links chemical manufacturers with end-users across various industries, ensuring the efficient supply of essential chemicals. As we look ahead, several factors will drive the growth of the chemical distribution market, including rising industrialization, emerging market expansion, and the increasing demand for specialty chemicals. In this in-depth analysis, we’ll discuss the market forecast, CAGR (Compound Annual Growth Rate), key growth drivers, major players in the industry, and the challenges the sector faces. This post also includes a forecast graph to provide a clear visualization of the anticipated market growth.

- Current Market Overview

As of 2023, the global chemical distribution industry is valued at approximately USD 276.4 billion, with steady growth in the past decade. The increasing demand for chemicals in industries such as construction, agriculture, automotive, healthcare, and consumer goods is the primary driver of this growth. Distributors play a key role in delivering chemicals to industrial customers, offering value-added services like formulation, packaging, and technical support.

The market is segmented into two primary categories:

- Commodity Chemicals: Mass-produced chemicals for industrial applications, including petrochemicals and polymers.

- Specialty Chemicals: Custom products like adhesives, coatings, and additives, often tailored to specific industry needs.

- Market Forecast for 2024–2029

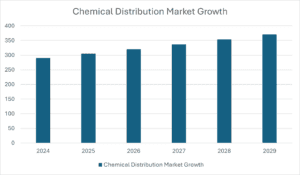

The global chemical distribution market is forecasted to grow at a CAGR of approximately 5.1% from 2024 to 2029. By the end of this period, the market is expected to reach a valuation of USD 370.8 billion. This growth will be fueled by the increasing demand for specialty chemicals, the expansion of the Asia-Pacific region, and the shift toward environmentally sustainable chemicals.

Projected Market Growth (2024-2029)

- Key Drivers of Market Growth

a) Emerging Markets Expansion

Emerging markets in Asia-Pacific and Latin America are expected to lead the charge in the chemical distribution market. Industrial activities, urbanization, and infrastructure development in countries like China, India, and Brazil will significantly boost demand for both commodity and specialty chemicals.

- Asia-Pacific: This region accounts for almost 50% of the global chemical distribution market revenue. Rapid industrialization and increasing demand in sectors like automotive, construction, and electronics are major contributors to this growth.

- China: As the world’s largest player in the chemicals sector, China’s vast investments in petrochemical and specialty chemical distribution make it a key market.

- India: India’s chemical market is rapidly growing, particularly in agriculture, pharmaceuticals, and consumer goods, creating huge opportunities for chemical distribution.

b) Rising Demand for Specialty Chemicals

The rising demand for specialty chemicals is a major driver of market growth. Specialty chemicals are used in specific, high-value applications across industries like water treatment, pharmaceuticals, food processing, and personal care. Distributors offering these chemicals can differentiate themselves and generate higher profit margins.

- Water Treatment Chemicals: With growing concerns about water conservation and pollution, the demand for water treatment chemicals is surging, particularly in water-scarce regions.

- Personal Care & Cosmetics: The global demand for innovative formulations in cosmetics and skincare products is driving demand for specialty chemicals such as emulsifiers, preservatives, and fragrances.

c) Shift to Sustainable and Green Chemicals

The shift towards green chemistry and sustainable chemical solutions is transforming the industry. Companies are adopting eco-friendly chemicals that are biodegradable, renewable, or less toxic to meet growing consumer and regulatory demands. This trend is particularly strong in Europe and North America, where governments enforce strict environmental regulations on chemical use and disposal.

Key product segments driving this shift include:

- Biopolymers: Increasingly used as sustainable alternatives to traditional plastics.

- Green Solvents: Favored in industries such as coatings, adhesives, and pharmaceuticals due to their reduced environmental impact.

d) Digitalization and Technological Integration

Digital transformation is reshaping the chemical distribution industry. Distributors are increasingly adopting digital platforms to streamline operations, enhance customer service, and improve supply chain transparency. E-commerce and digital sales channels are making it easier for distributors to reach new customers and provide real-time product availability and delivery tracking.

- E-commerce in Chemical Distribution: Online platforms allow for more efficient purchasing and logistics, opening up new business opportunities and improving customer satisfaction.

- AI and Automation: Advanced technologies like AI are optimizing the supply chain, predicting demand patterns, and enhancing inventory management. These innovations will drive growth by improving efficiency and reducing costs.

- Challenges in the Chemical Distribution Market

a) Volatility in Raw Material Prices

One of the primary challenges facing chemical distributors is the fluctuation of raw material prices, particularly in petrochemicals. Price volatility can affect profitability and create supply chain disruptions, impacting pricing strategies for distributors. Geopolitical events and changes in global oil production levels further exacerbate this issue.

b) Regulatory Compliance

The chemical industry is heavily regulated, with strict safety and environmental standards across different regions. Regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in Europe and the Toxic Substances Control Act in the U.S. require companies to maintain compliance, which can be costly and complex.

Navigating these regulations is crucial for distributors, especially as governments continue to tighten rules around chemical safety and sustainability.

- Major Players in the Chemical Distribution Market

Several key players dominate the global chemical distribution market. These companies have established large-scale networks, comprehensive product portfolios, and strong relationships with chemical manufacturers, enabling them to serve a wide range of industries.

a) Brenntag AG

- Headquarters: Germany

- Revenue (2023): USD 19 billion

Brenntag is the world’s largest chemical distributor, with operations in more than 70 countries. Its wide product range includes industrial chemicals and specialty chemicals, catering to industries like food processing, pharmaceuticals, water treatment, and oil & gas.

b) Univar Solutions

- Headquarters: USA

- Revenue (2023): USD 11.5 billion

Univar Solutions has a strong presence in North America and Europe, focusing on specialty chemicals and value-added services. The company emphasizes sustainability and digital transformation to improve its supply chain efficiency.

c) IMCD Group

- Headquarters: Netherlands

- Revenue (2023): USD 5.4 billion

IMCD specializes in specialty chemicals, serving industries like pharmaceuticals, food, and personal care. The company has expanded its reach across Europe, Asia-Pacific, and the Americas, focusing on providing tailored chemical solutions to niche markets.

d) Nexeo Solutions (Univar Acquisition)

- Headquarters: USA

Nexeo Solutions, now part of Univar, focuses on industrial and specialty chemicals with a global network spanning 80 countries.

e) Azelis

- Headquarters: Belgium

Azelis is a fast-growing player in the specialty chemicals market, with a strong focus on industries such as coatings, personal care, food ingredients, and pharmaceuticals.

- Conclusion and Future Outlook

The global chemical distribution market is set for steady growth, with a forecasted CAGR of 5.1% over the next five years. The demand for specialty chemicals, sustainable chemical solutions, and the expansion of emerging markets will be the key drivers behind this growth. Companies that embrace digital transformation, navigate regulatory challenges, and focus on sustainability will have a competitive edge in the future.

As industries continue to evolve and demand more complex chemical solutions, the role of distributors will become increasingly vital in ensuring a seamless and efficient supply chain. The next five years will see continued innovation, technological integration, and a stronger emphasis on green chemistry, setting the stage for long-term success in the chemical distribution sector.

Sources:

- Grand View Research, Chemical Distribution Market Analysis (2023)

- Market Research Future, Global Chemical Distribution Market Forecast (2024-2029)

- Statista, Revenue of Leading Chemical Distributors Worldwide (2023)

- Frost & Sullivan, Digitalization in Chemical Distribution (2023)

By Andrew Vandegrift

Principal at EdgeWork Capital.

Recent Comments